Frequently Asked Questions

Last Updated: 2nd September 2022

Currently, Novus Black Fund UK Ltd does not hold a significant pool of excess capital that can be used to ensure that investor returns are paid at the highest capped monthly rate, although this is the plan. Consequently, we had to reduce the July monthly return paid as this was for one out of the first twelve trading months. However, the other 11 were at the maximum rate of return.

Now that the one-off expenditure associated with any start-up firm and especially the move to regulated status have been absorbed, we can fix our monthly operating costs. This means entering our second trading year the fund aims to deposit 20% of the trading profit after expenses and investor remunerations with a top 10 asset management firm ranked by total AUM. As a result, Novus Black can create excess capital as a “War Chest” that can be used to top up months that do not reach the highest capped return.

KPMG continue to be engaged to perform six monthly trading performance reviews, with the period from February to August being available at the end of September. This relationship has existed since Novus Black Ltd was launched as a Private Investment Club in July 2021 and will continue for the foreseeable future.

Novus Black started life as a private investment club; therefore, Novus Black needed no audit. However, Following the launch of Novus Black Fund UK Ltd as a UK-regulated AIFM in May, audits are now required. After speaking to KPMG, they suggested we use a smaller firm for the fund’s first audit, which will be in May 2023. They have recommended a list of auditing firms that operate in the fund industry, and we plan to sign an engagement agreement in the next month.

My Fx Book is not, in fact, inaccurate they calculate risk (drawdown) differently from how institutional trading desks calculate it. There Is much confusion in the FX Community regarding how My Fx Book calculates drawdown, but it’s based on cumulative realised and non-realised losses since the account’s inception. For example, say we took a trade on USD/JPY, and for four weeks of the trade, it went into a negative position but was closed out in profit. My FX Book would still have recorded that position as a negative drawdown.

Institutional Trading Desks calculate drawdown based on real-time floating P&L daily, which is much more relevant to current risk.

Novus Black Fund UK Ltd has transitioned from MyfxBook to FxBlue for consolidated reporting of Floating P&L. An additional reason for this change is that Myfxbook does not support institutional brokers such as IS Prime Ltd, who has been appointed as the primary broker for the fund.

The current drawdown over Novus Black’s three broker accounts is 13.8%.

The screenshot below is from FX Blue and shows historical drawdown, which has never exceeded 15% across all accounts. Regarding drawdown, we are implementing new systems and strategies to reduce this and closing out more historical trades.

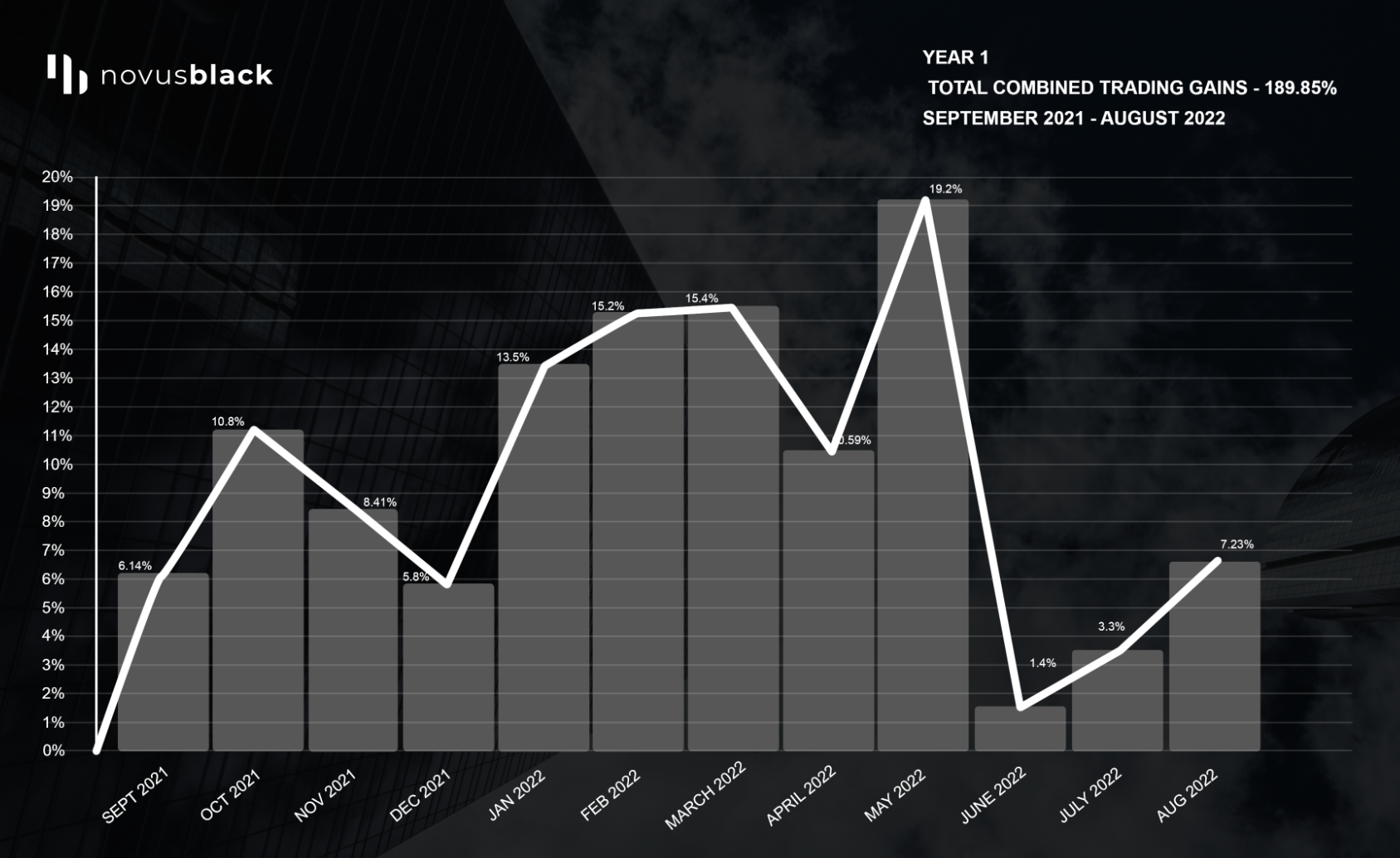

The graph below shows the profit made since September 2021.

Newly appointed head trader Gary Wayne manages and oversees all trading activities and individual traders within particular markets, FX, Indices and Commodities. Novus Black can provide a copy of Gary’s C.V upon request showing his financial and FX-based employment history.

MCI Global Investment Advisors Ltd is a UK authorised Alternative Investment Fund Manager regulated by the FCA under FRN 948996, https://register.fca.org.uk/s/firm?id=0014G00002fd8htQAA. MCI has been appointed the fund manager of Novus Black Fund UK Ltd under an investment management agreement.

Novus Black owns full intellectual rights to all software and systems and holds secure zip files for regularly updated and maintained code.

The short answer to this question is Yes, and No. Forex markets cannot completely crash, but specific currencies can crash anytime. Crashes in the Forex markets differ from those in the stock markets because Forex crashes usually affect a particular currency.

For systemic protection of the portfolio, Novus Black includes asymmetrical hedging (holding counter positions to our current directional trades). This means that we will utilise pre-set position hedging to protect our core directional trades -instrument by instrument traded.

Our head trader has over 30 years of trading operations experience, and the Director of the Financial operations team has 35 years of experience in holding senior positions at Global Investment Banks, Tier 1 Brokers and Exchange Groups. CVs and Bios are available upon request.

The risk of cash in transit is mitigated by the FCA/Cass-approved Cash Custodian, Globacap. Cash is sent directly from the investor to the Cash Custodian and held in a segregated client account. During the period capital is traded cash is held by regulated brokers in segregated client accounts. At no point is investor capital handled by Novus Black.

Trading Risk is mitigated by risk management trading strategies and the systems that support them. Our head of trading and his team have built these, who have over 30-year experience in capital markets.

A foreign exchange broker, FX, or forex broker is a financial service provider that lets you buy and sell currency. The broker acts like a middleman and sits between the traders and the interbank, a global market that allows you to trade foreign currency.

Novus Black Fund UK partners with Brokers that are fully regulated to ensure maximum protection. Currently, we use IS Prime (Regulated by FCA), IC Markets (EU Ltd) and VT Markets (EU Ltd) regulated by CySEC (Cyprus Securities and Exchange Commission) and all of which are regulated under ESMA (European Securities & Markets Authority).

Although there are reports that some traders use leverage ratios of up to 440:1, we do not subject ourselves to that kind of risk and instead like to be responsible with our trading activities. Typically, our main account uses a leverage of 1:30; this means we can open a position 30 times the size of our margin.

Novus Black’s current win rate as of 2nd September 2022 is 89.1%

Since September, we have placed a total of 5,230, which averages 100 per week. Out of the 5,230 trades placed, we have won 4,660 of them.

Novus Black is not a bot; Novus Black is a combination of experienced institutional traders manually assessing the market whilst in-house developers programme proprietary software to aid them with their strategy.

Novus Black uses technology to assist and not control, which is a crucial distinction. As a real-life example, the recent war in Ukraine and uncertainty in the Far East rendered many bots and automated trading solutions useless, with most reporting heavy losses. This is because the markets moved outside historical data parameters, which bots were not programmed to react to.

Novus Black uses real people with real expertise and the ability to react instantly to ever-changing market conditions.

Novus Black Ltd is the sales, marketing and operational division, whereas Novus Black Fund UK Ltd is the regulated AIFM (Alternative Investment Fund Manager)