In this comprehensive update, we’re going to explore an in-depth analysis of the activities from January, looking forward to what 2024 holds and what it means for investors. We’ll also discuss trading strategies, our ongoing efforts to streamline operations, and our expansion plans. These efforts are aimed at providing benefits to our clients and further strengthening and enhancing our brand.

Excellent Start To 2024

The year began on an exceptional note with an 8.08% profit, signaling a promising commencement to our third year in 2024. This achievement underscores the importance of maintaining our momentum, leading us to persistently innovate and refine our strategies and methods for greater reliability. A major part of our strategy focuses on the formulation of strong plans aimed at reducing risks and strategically eliminating all Legacy positions by the end of the fourth quarter.

In the last month, our dedicated team has been actively engaged in enhancing our already excellent operations. This effort started with a detailed retrospective analysis of our practices, strategies, trades, and both our successes and setbacks. We also ventured into new strategic territories, assessing how these could have impacted our performance had they been applied last year. In collaboration with our FCA-regulated cash custodian, the FCA Regulator, and a number of esteemed financial institutions (to be disclosed in time), we undertook exhaustive profit and loss analyses, conducted thorough reviews of all trades, and gauged the likelihood of their success. A critical component of these evaluations was a heightened focus on risk management, seeking to implement even tighter controls to protect our clients.

Adding Funds to Your Investment

Over the past 14 days, we have temporarily suspended the acceptance of new deposits. This temporary measure is in response to stringent regulatory obligations, necessitating a standard but thorough and comprehensive review conducted by our FCA-regulated cash custodian.

During this evaluation period, the deal page and, consequently, the capability to add funds to clients’ Novus Black accounts were temporarily disabled. We are currently in the final stages of this review and anticipate the resumption of accepting new investments shortly.

We sincerely appreciate your understanding and patience throughout this process. We need to convey that your financial security is our top priority. These regulatory reviews are not only mandatory but also serve as a testament to our commitment to ensuring that your investments are held to the highest standards of safety and compliance.

As partners in this journey, we want you to feel confident and secure, knowing that Novus Black is unwavering in its dedication to regulatory adherence. Your trust is paramount, and these measures are taken to safeguard your investments and provide you with peace of mind.

Novus Black Engages Thistle Inititatives

In our latest assessments, we joined forces with Thistle to begin conducting an extensive financial crime audit, scheduled for early February. Novus Black remains steadfast in its commitment to delivering an exceptional service that yields excellent returns for clients. Simultaneously, we prioritize transparency, longevity, and take all necessary steps to ensure sustainability. As a result of this, all clients should be aware that they may be required to complete additional KYC checks to comply with the findings of the audit.

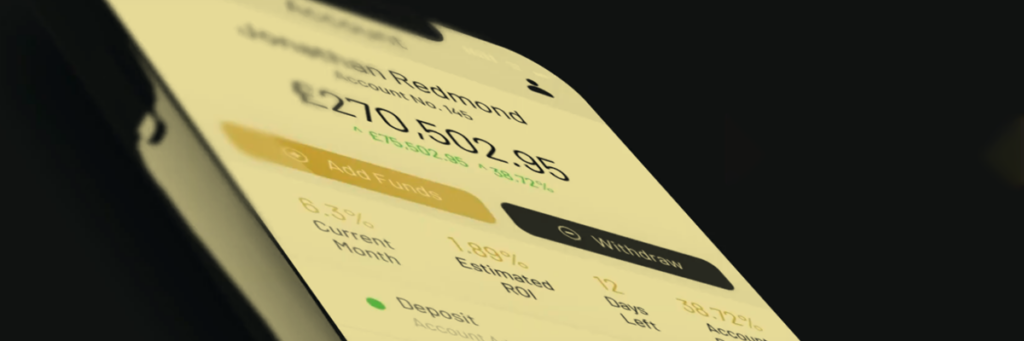

Performance Updates On Our App

It’s important for clients to understand that checking the Novus Black app every day with the expectation of immediate profit may not align with our trading strategy. Unlike some investment approaches that involve frequent opening and closing of trades, our methodology involves strategic decision-making. We don’t execute trades every single hour; instead, we carefully analyze the market, waiting for the opportune moment to open and close positions.

This patient and strategic approach allows us to extract the maximum profit while minimizing risk. Therefore, if you do check the app and find no movement for a few days, please do not panic or worry. It is purely a strategic trading decision that will ultimately lead to beneficial outcomes for clients. This disciplined approach ensures that we prioritize precision over frequency, making informed decisions that contribute to the long-term success of our investment strategies.

January Trading Overview

The year started strongly, focusing on both major and minor currency pairs, with a cautious approach due to early-year market volatility. Key January highlights include:

US unemployment stable at 3.7% for December.

US CPI exceeding forecasts.

Bank of Japan and Bank of Canada holding interest rates steady.

The European Central Bank and Federal Reserve also maintained their interest rates.

These decisions shaped January’s currency market dynamics. The Dollar Index modestly increased by 0.15%, influenced by the Federal Reserve’s unchanged rate decision on January 31st, hinting at no immediate rate cuts but leaving the door open for future adjustments. This led to a slight USD gain to 103.70 after the announcement.

Market expectations have shifted, reacting to Powell’s comments and the broader economic landscape, hinting at a cautious outlook for early rate cuts. Upcoming jobs and inflation data will be key in determining future Fed actions.

In equities, the NASDAQ 100 and S&P 500 hit new highs, though the NASDAQ faced some late selling, indicating potential short-term profit-taking. However, the S&P 500’s bullish close suggests continued investor confidence, supported by a strong US economy and a recent 3.3% GDP growth rate. The technical outlook for stocks remains positive, suggesting potential gains ahead, making long positions appealing to traders and investors.

February Look Ahead

The upcoming weeks are set to be dominated by key central bank policy meetings, which are expected to be the most significant events impacting the financial markets.

For the GBPUSD pair, the market is eagerly awaiting the release of critical data, including the German Preliminary Consumer Price Index (CPI) and the US Non-Farm Payrolls and Average Earnings. These data points are expected to bring added depth to the week’s financial analysis. Specifically, the focus for the GBP will be on the Bank of England (BoE), which has its Interest Rate Decision scheduled for Thursday, February 1, at 12:00 pm. Market participants widely anticipate that the BoE will hold the policy rate steady at 5.25% for the fourth consecutive time, a move that is likely to influence GBP valuations significantly.

The EURUSD pair has seen considerable fluctuations over the past month, notably dipping to a new low of 1.0795 in the wake of the European Central Bank (ECB) interest rate decision, followed closely by the Federal Reserve’s rate announcement and subsequent press conference. According to the 4-hour chart analysis, the EUR/USD pair is currently positioned neutrally. If buyers manage to propel the price above the 1.0900 threshold, further upward momentum could be anticipated, with the next significant resistance level at 1.0910, ahead of a potential push towards 1.1000. Conversely, if sellers maintain control and keep the price below 1.0900, a retracement could be on the horizon, targeting the day’s lows around 1.0806.

In the AUDUSD market, the Australian dollar has weakened following the release of Australia’s Consumer Price Index, which came in lower than anticipated. This development has led investors to speculate that the Reserve Bank of Australia (RBA) may opt for two rate cuts within the year, amidst concerns over Middle Eastern geopolitical tensions negatively impacting the AUD/USD pair. December’s inflation rate in Australia stood at 3.4%, falling short of expectations. Despite this, the figures still lie within the RBA’s target inflation range of 2.0% to 3.0%. The Reserve Bank is slated to keep interest rates unchanged in its forthcoming meeting on February 5 and 6.

The USDJPY pair remains in a tight trading range, influenced by a mix of domestic economic data weaknesses, geopolitical risks, China’s economic challenges, and a slightly hawkish stance from the Bank of Japan (BoJ).

For the USDCAD pair, a rebound from 1.3360 was observed following Federal Reserve Chairman Powell’s press conference. The Federal Reserve is likely to maintain its interest rate policy, while falling oil prices exert pressure on the Canadian Dollar. Despite these uncertainties, a glimmer of optimism emerged as Powell hinted at a possible consensus on rate cuts in 2024. Canada’s Gross Domestic Product (GDP) outperformed expectations, bolstering the CAD against the USD, though it remains weaker compared to other major currencies. The financial markets are keenly awaiting the Canadian PMI data release on Thursday, post-Federal Reserve’s decision. Market sentiment remains cautious ahead of the Fed’s forthcoming rate decision and the release of January’s ADP Employment Change data. Should the price ascend above 1.3455, targets are set at 1.3500 and 1.3540, whereas a decline below 1.3350 could find support at 1.3300.

The NZDUSD pair is currently hovering around 0.6120, following the Federal Reserve’s decision to leave interest rates unchanged. The Reserve Bank of New Zealand’s (RBNZ) Chief Economist, Paul Conway, has adopted a cautiously optimistic outlook. Despite an increase in ANZ Business Confidence to 36.6, the ANZ Activity Outlook has decreased to 25.6%, indicating a cautious stance among New Zealand businesses. Buyers looking to regain control of the market might aim to push NZDUSD towards 0.6176, overcoming resistance established on December 28, 2023. Conversely, sellers may seek a correction, potentially breaking below the 0.6047-0.6092 zone. Overall, the NZDUSD pair is trading laterally as participants likely concentrate on pivotal market developments.

The month of February is anticipated to be marked by significant economic announcements expected to sway market volatility, including decisions on monetary policy and interest rates by the BoE, RBA, and RBNZ, as well as critical US economic data releases such as the Non-Farm Employment Change, CPI, and unemployment figures.

Join the Novus Black Golf Team for Putting for Pounds!

Exciting news! Novus Black is once again supporting Putting for Pounds, an event organized by our valued client and shareholder, Cliff Barry, for HAFGB. As part of our ongoing commitment to philanthropy, we’re sponsoring this fantastic initiative.

This year, we’re taking it up a notch and forming our own Novus Black golf team. If you’ve got some golfing skills and a passion for a good cause, we want you on our team! Last year, we raised over £30,000, and we’re aiming to triple that amount this year.

Novus Black will cover all expenses for our team, making it a cost-free and enjoyable day for everyone involved. The event will take place at the splendid Bowood Hotel, Spa, and Golf Resort in Wiltshire, offering a delightful day of golf, food, and drinks.

While winning isn’t everything, we do aim to secure a spot in the top three teams. If you’re up for the challenge and can genuinely play, we encourage you to reach out directly. Please note although the team at Novus Black can make money, we can not play golf, so we will not be dragging the team down.

Let’s swing into action for a great cause!

Luxury Real Estate News

One of the most thrilling aspects for us at Novus Black is witnessing success stories that result from the profits generated through investments with us. A prime example of such success is Azzaryaat, affectionately known as Azz among friends.

Azz has utilized his gains to establish his own bespoke, high-end Estate Agency in London. Azzaryaat Estates specializes in Luxury Real Estate on an international scale. Having known Azz for some time, we are delighted by his achievements, and we’ve been truly impressed by the remarkable properties he sources and sells for his clients, ranging from opulent mansions to stylish penthouses and lucrative commercial plots. Azz’s expertise is genuinely exceptional.

Similar to Novus Black, he takes pride in delivering a personalized, one-on-one service from the initiation of a deal to its successful completion. Whether you’re considering entering the market as a buyer or seller, Azz is the person to consult, and he can guide you on your Real Estate journey. We are thrilled that Novus Black has played a role in helping him achieve his dream. Best of luck, Azz!

If you wish to learn more, please contact Azz directly at 07460 981569 or via email at azzaryaat.ali@theestate.agency.