U.S. Job Growth Surges in November, Unemployment Rate Drops to 3.7%

In November, the U.S. labor market demonstrated notable strength, with the addition of 199,000 jobs, a significant increase from the 150,000 jobs added in October. This surge in non-farm payroll employment, as reported by the Bureau of Labor Statistics, surpassed expectations and signaled resilience in the face of higher interest rates. Consequently, the unemployment rate […]

Spending Spurs Faster Malaysia GDP Growth

In the face of global economic uncertainty, Malaysia’s economy has demonstrated remarkable resilience, as evidenced by its accelerated growth in the third quarter. The nation’s economic expansion, primarily fueled by robust consumer spending and the strength of its services and construction sectors, has effectively countered the challenges posed by a slowdown in exports. The latest […]

The Bank of Japan Edges Toward Abandoning Negative Interest Rates

The Bank of Japan (BoJ) has recently signaled a potential shift in its monetary policy stance, as indicated by the minutes from its October meeting. There is a growing alignment with the conditions necessary for moving away from the era of negative interest rates. The bank’s updated forecasts suggest a rising inflation trajectory through to […]

Germany’s Annual CPI Inflation Dips Below Market Expectations in October

In October, Germany’s inflation, as tracked by the Consumer Price Index (CPI), noted a downturn, settling at 3.8% year-on-year. This figure marked a decrease from September’s 4.5% and failed to meet the market’s anticipated rate of 4%. On a month-on-month basis, the CPI observed no alterations. The softening inflation is seen as a sign of […]

Gold Prices Ascend Amid Israel-Palestine Tensions

As geopolitical unrest deepens in the Israel-Palestine region, gold prices exhibit potential for continued growth. Concurrently, the US Dollar remains stable, notwithstanding the robust US Retail Sales data for September. Furthermore, with the 10-year US Treasury yields climbing to 4.85%, there’s anticipation for an additional interest rate hike by the Federal Reserve. On Wednesday, gold […]

Gold price comes under pressure as yields revive after US Inflation report

Gold price (XAU/USD) faces some selling pressure as the Inflation report for September remained majorly in line with estimates. The monthly core Consumer Price Index (CPI) that excludes volatile oil and food prices expanded by 0.3% and the annual data decelerated to 4.1% as expected by the market participants. The headline inflation remained higher than expectations as […]

Pound Rallies on Positive UK GDP Report

The British pound found some respite this Friday morning from both the US dollar and the local UK GDP release (see economic calendar below). UK GDP beat estimates on the headline YoY print as well as the business investment metric. An overall positive report that was driven by the production sector from an output point of view as well as an […]

Breaking: BoE keeps interest rate on hold in split vote

The Bank of England (BoE) announced that it left the policy rate unchanged at 5.25% following the September policy meeting. Markets were expecting the BoE to raise the interest rate by 25 basis points to 5.5%. The BoE’s Monetary Policy Committee (MPC) voted 5-4 in favor of holding the policy rate steady. Governor Bailey, policymakers […]

UK Growth Contracts Leaving Pound on Offer

The British pound looks to enter the European trading session on the backfoot after UK GDP (see economic calendar below) missed on both 3-month average and YoY figures respectively. The MoM print is quite surprising in that the economy contracted by 0.5% (quickest pace in 7 months!) as opposed to the 0.2% expected. In contrast to the prior print, the UK economy seems […]

Pound Sterling looks set to further falls as BoE sees policy sufficiently restrictive

The Pound Sterling (GBP) cracked significantly amid increasing risk-aversion and dovish remarks from Bank of England (BoE) Governor Andrew Bailey and policymaker Swati Dhingra about September’s monetary policy decision. The GBP/USD pair is expected to remain on tenterhooks as policy divergence between the BoE and the Federal Reserve (Fed) is likely to persist if the UK’s central bank decides […]

US Holiday Today but Focus Could be on China

Asian stocks look set for a positive open, with Nikkei +0.32%, ASX +0.71% and KOSPI +0.19% at the time of writing. The Nasdaq Golden Dragon China Index was up 3.2% last Friday, digesting the recent fresh moves from China authorities to support the CNY and its housing market. China’s financial regulators have cut the down-payment requirements for first and second-time home […]

Japanese Yen Makes a U-Turn

The Japanese Yen might be showing early warning signs that the currency might be getting ready to reverse against the US Dollar. Over the past 24 hours, USD/JPY broke under the 145.07 inflection point that was established in late June. This followed the presence of negative RSI divergence showing fading upside momentum. That can at times […]

Dollar retreats from 2-month high, yuan turns higher

The dollar fell from a two-month high on Monday following five straight weeks of gains, as risk sentiment improved in Europe, with attention already turning to the Federal Reserve’s Jackson Hole symposium which kicks off on Friday. The dollar index, which measures the currency against six other majors, was last down 0.2% at 103.18, but still […]

Sterling rises as UK wage growth adds to BoE inflation worries

LONDON (Reuters) -Sterling rose on Tuesday after data showed British basic wages grew at a record pace in the second quarter, adding to the Bank of England’s worries about inflation. The pound was last 0.2% higher at $1.2711, after rising as much as 0.28% to $1.2720 following the data. It was flat against the euro […]

Asia FX weakens amid China fears, dollar strong after CPI

Most Asian currencies fell on Friday amid persistent fears of an economic slowdown in China, while the dollar firmed after data showed that U.S. consumer inflation grew as expected in July. Rising U.S. Treasury yields also pressured local currencies, while expectations that the Federal Reserve will keep interest rates higher for longer kept the dollar buoyant. Data […]

US Dollar Rallies on Soaring Yields

The U.S. dollar, measured by the DXY index, climbed on Tuesday, marking its fourth consecutive trading session of gains and reaching its best levels since July 10 (DXY: +0.52% to 102.40). This advance was driven primarily by rising U.S. Treasury yields, with the 10-year note topping 4.0% and approaching the peak observed last month. Encouraging […]

EUR/USD Up After Fed Hike but Skating on Thin Ice

The U.S. dollar took a turn to the downside on Wednesday following the July FOMC announcement. Although the Fed raised interest rates by 25 basis points to 5.25%-5.50%, it did not adopt an aggressive outlook, with Chairman Powell refraining from definitively signaling further policy firming. The overall tone drove Treasury yields lower, pushing EUR/USD towards the 1.1100 handle. The euro’s […]

UK (GBP) Breaking News: UK CPI Miss Troubles Pound

The British pound slipped after the UK CPI report (see economic calendar below) missed estimates on both headline and core inflation respectively falling from 30-year highs. The key focus was the core inflation print (6.9%) that could indicate a possible peak in the inflation cycle and the impact of the aggressive monetary policy adopted by the Bank of England (BoE). As welcome sign for […]

Markets Might be Pricing in Policy Uncertainty That May Present Opportunities

Going into the third quarter, the macro environment for financial markets is characterized by several central banks potentially nearing the peak in the tightening cycle. The lingering issue in most parts of the world is that inflation remains stubbornly elevated. The notable exceptions from a tightening policy are the Bank of Japan and the People’s Bank of […]

Fed minutes support Fed members inflation concerns

At the June meeting, some Federal Reserve policymakers suggested they would have supported raising interest rates, despite the decision to leave them unchanged. According to the minutes released, several officials argued in favor of a rate increase due to stronger-than-expected economic activity and no clear signs of inflation returning to the Fed’s 2% target. Despite […]

China, Japan joined at the hip in FX war

ORLANDO, Florida, June 28 (Reuters) – Japan and China may be signaling that they want their currencies to stop weakening too much, but the reality is depreciating exchange rates will help give Asia’s economic giants the inflation and competitive edge both are currently seeking. What’s more, deepening trade links between the two countries and competition […]

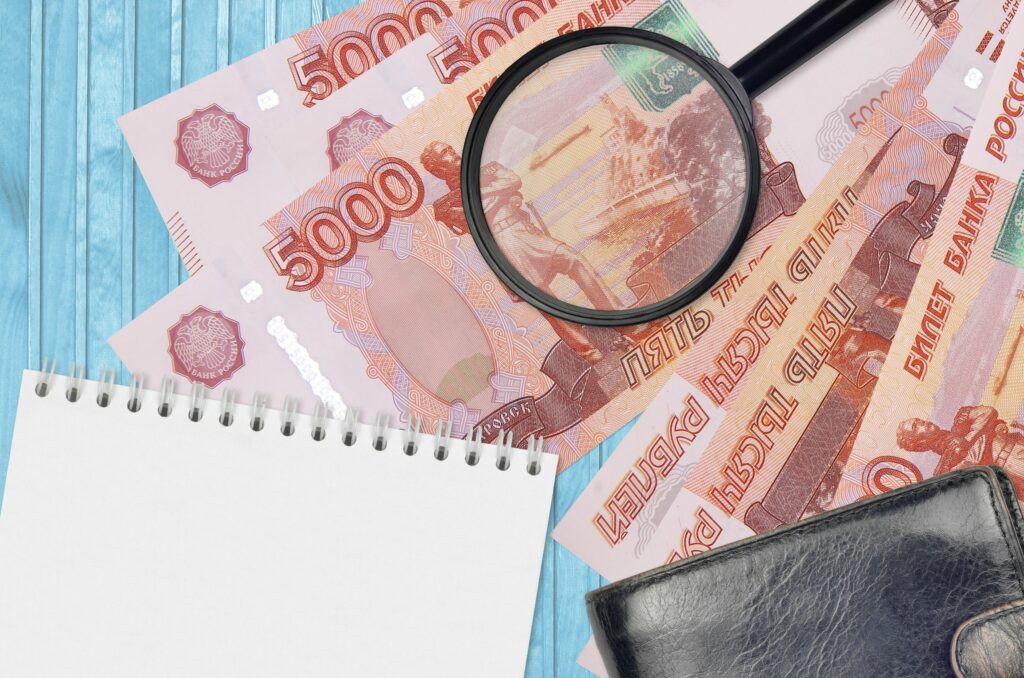

Ruble Hits Weakest in 15 Months After Wagner Challenges Putin

The ruble weakened as much as 3% against dollar on Monday, the most this year, after a mutiny by mercenary commander Yevgeny Prigozhin, whose brief uprising represents the biggest threat to President Vladimir Putin’s political control in his almost quarter century in power. The Russian currency narrowed losses to trade 0.6% weaker at 85.1050 per […]

US Indices fall as Powell says inflation fight not over

Global stock indexes fell on Wednesday as Federal Reserve Chair Jerome Powell said the fight to lower inflation still has a “long way” to go, while grains prices jumped on worries about crop shortfalls around the globe. The U.S. dollar was lower and Treasury yields were little changed. After lifting interest rates by 5 percentage […]

EUR/USD under pressure with eyes on ECB-speak

EUR/USD is trading on the defensive below 1.0950 on Monday. The pair is weighed down by the US Dollar recovery and risk aversion, as investors digest US-Sino headlines amid mounting Chinese growth fears. ECB-speak will be in focus. US markets are closed on account of Juneteenth. The EUR/USD pair consolidates last week’s gains and retains its bullish […]

US Dollar heading into a volatile week

The US Dollar (USD) almost pairs back all of its incurred losses at the start of the US trading session, as traders brace for a slew of events and macroeconomic numbers planned later this week. Important datapoints to have in mind for this week are the US Consumer Price Index (CPI) numbers on Tuesday, Industrial Production […]

British Pound at Mercy of Peers in Light Data Week: GBP/USD, GBP/JPY, GBP/AUD Price Setups

In a relatively light week regarding UK macro data, the British pound could be at the mercy of some of its peers. After a spectacular run of outperformance since February, UK macro data have generally underwhelmed since mid-May, according to the Economic Surprise Index. Nevertheless, the strong-than-expected data since the start of the year has prompted upgrades […]

U.S. stock futures slip after disappointing China data, as debit-ceiling vote looms

U.S. stock futures were lower Wednesday after data signaling a slowing Chinese economy sparked risk-off trading across markets. How are stock-index futures trading On Tuesday, the Dow Jones Industrial Average DJIA, -0.15% fell 51 points, or 0.15%, to 33043, the S&P 500 SPX, +0.00% increased 0 points, or 0%, to 4206, and the Nasdaq Composite COMP, +0.32% gained 42 points, or 0.32%, to 13017. […]

US Dollar mixed on Monday as debt ceiling talks stall

The US Dollar (USD) is showing a very mixed picture this Monday with two clearly defined regions explaining why the US Dollar Index (DXY) is going nowhere. The US Dollar is gaining against most G7 currencies, with the exception of Asian pairs such as the South-Korean Wong (KRW) and the Japanese Yen (JPY), which are […]

GBP/USD refreshes weekly high above 1.2650 as BoE prepares for a fresh rate hike

GBP/USD has printed a fresh weekly high at 1.2653 in the early European session. The Cable has shown a stellar rally and is expected to extend its upside as the Bank of England (BoE) is preparing for a fresh interest rate hike this week. Thursday’s Bank of England (BoE) interest rate policy will be keenly […]

US consumer spending flattens; core inflation still hot

U.S. consumer spending was unchanged in March as an increase in outlays on services was offset by a decline in goods, but persistent strength in underlying inflation pressures could see the Federal Reserve raising interest rates again next week. Stubbornly high inflation was underscored by other data on Friday showing labor costs increasing solidly in […]

Banking turmoil means recession fears are creeping back

March 29 (Reuters) – The failures of U.S. lenders Silicon Valley Bank (SVB) and Signature Bank, followed by Credit Suisse’s rescue, and the ensuing turmoil in world markets have re-ignited the recession risks that appeared to have abated just a few weeks ago. Reporting by Yoruk Bahceli, Naomi Rovnick, Chiara Elisei, Amanda Cooper, additional reporting […]

Worst bank turmoil since 2008

The Federal Reserve faces a pivotal decision on March 22, 2023: whether to continue its aggressive fight against inflation or put it on hold. Making another big interest rate hike would risk exacerbating the global banking turmoil sparked by Silicon Valley Bank’s failure on March 10. Raising rates too little, or not at all as some are calling for, could not […]

EUR/USD Subdued as US Dollar Retains Upper Hand, Gold Can’t Shake Off the Blues

The US dollar, as measured by the DXY index, rose moderately on Thursday, touching seven-week highs near 104.70, as market sentiment remained fragile, depressing appetite for riskier currencies. Against this backdrop, EUR/USD continued its descent, falling around 0.10% and breaking below the 1.0600 handle for the first time since early January. Gold prices also retreated, extending losses […]

Sterling falls back from seven-month high hit in early trade

LONDON (Reuters) -Sterling retreated on Monday from a seven-month high against the dollar hit in Asian hours, having been helped last week by data showing the British economy was performing better than feared, which also drove expectations of more interest rate hikes. The pound hit $1.24475 in early trade, its highest since June 10. Moves […]